My friend Steve at PVA does not like when I talk about it, but I see Warren Buffett as the ultimate 'death kiss' indicator (not too far from Jim Cramer).

I know legends like Whitney Tilson have almost all his wealth in Berkshire, and I do have a few shares, still, I think every time I see a new Warren trade idea or 13F I know in my bones that the stock is death and volatility is drained from it.

Now

What does that mean for us?

Simple, less volatility less opportunity to make money.

So when everyone was happy he bought a massive stake in Occidental Petroleum, what do you think I did?

Yes, exactly. I sold my entire position banking in the process +110% in 6 months and closed every single Call option I was traded.

It is no secret I run a series of algorithms to scan the market and pinpoint when Wall Street's High Rollers are placing big bets, guess what? They are doing it right now.

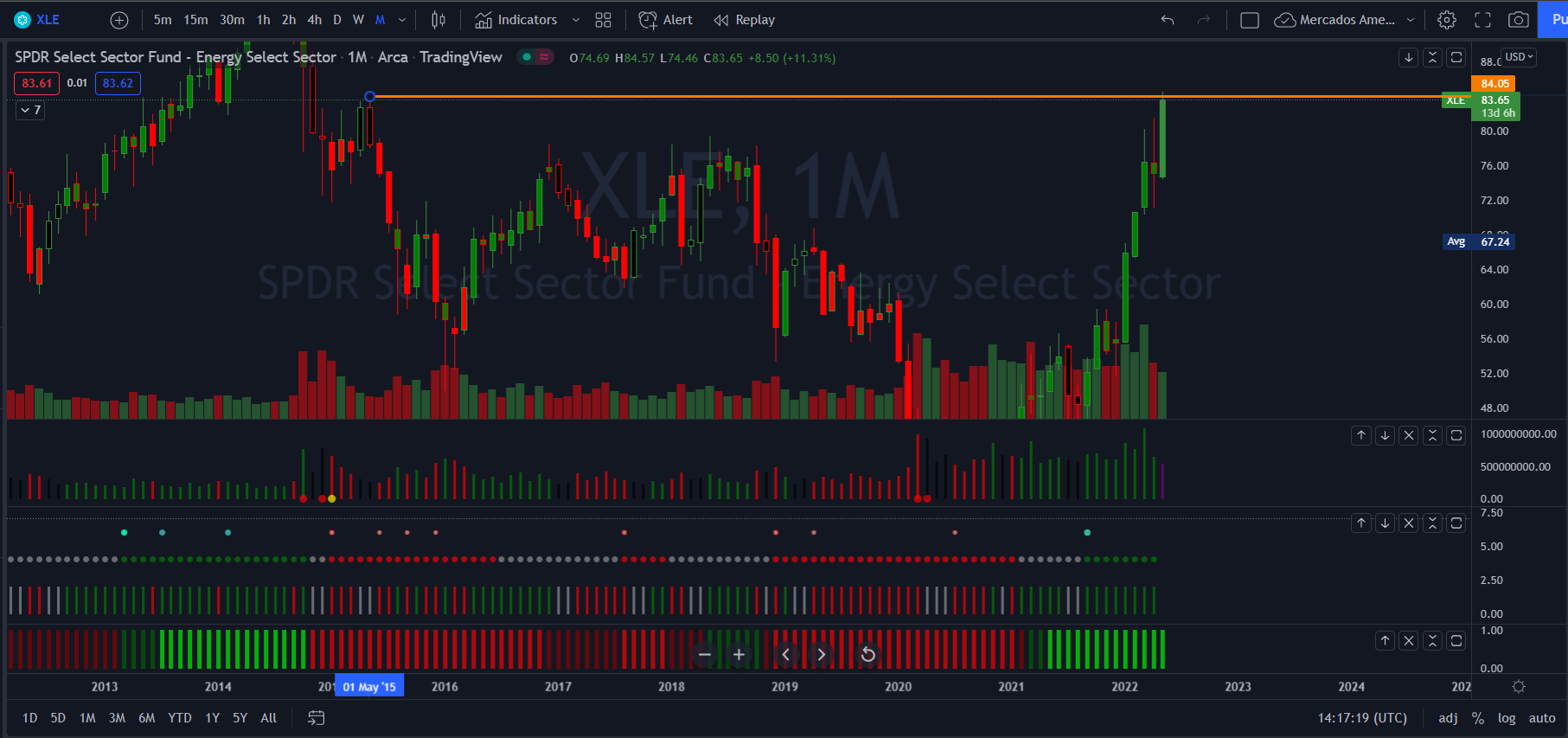

The energy sector has been on a roll since August 2021 paused in December, then thanks to Putin it exploded again.

Well, time for another break.

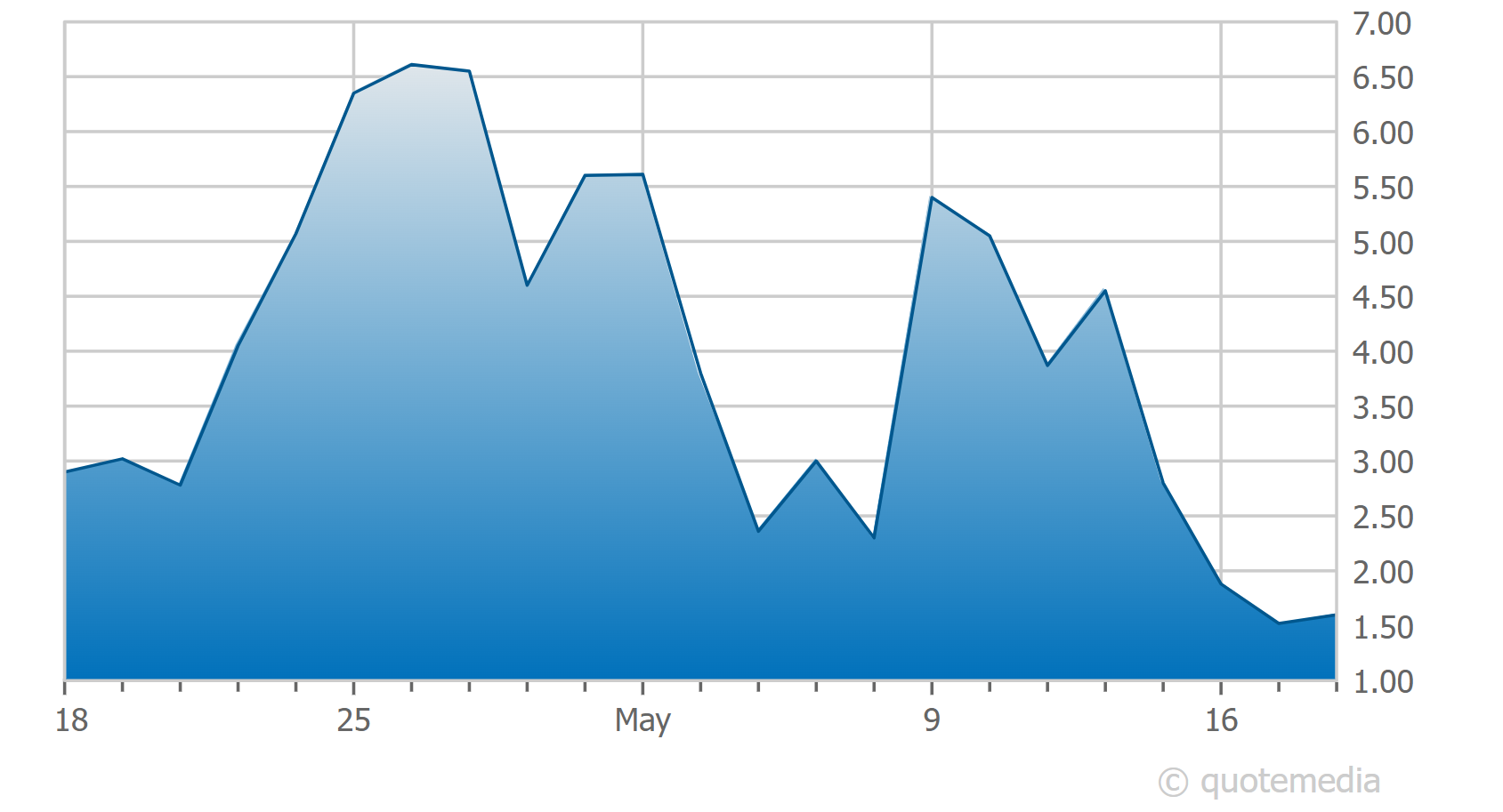

At 9:53 AM just now, someone picked 10,000 contracts on XLE, yes Puts.

And yes, again, that is close to $1.5M

I suggest you pick contracts under 1.90$. Never go all-In.

You can track the contract progress in quotemedia or on your broker platform.

Yes, up or down. It does not matter.

We need to be ready to seize every single opportunity. Once, you have Wall Street under surveillance nothing is a surprise and it becomes easier (not that we are going to win them all) to repeat the process.

Never forget

Someone Always Knows

FYI

Do you see that? XLE (Energy Sector) trades now at all-time highs similar to May 2015; How?

Something is very broken and we need to take advantage of it.