For copy purposes, the beginning of any post or article needs some words, but let us go directly to the meat for today's chart.

I am positive this ETF needs no introduction; IWM.

Yes, small caps. And if you are like me and you are ready to face the facts; we have been here so many times in the last 20 years I am in shock everyone avoids all the black and white evidence.

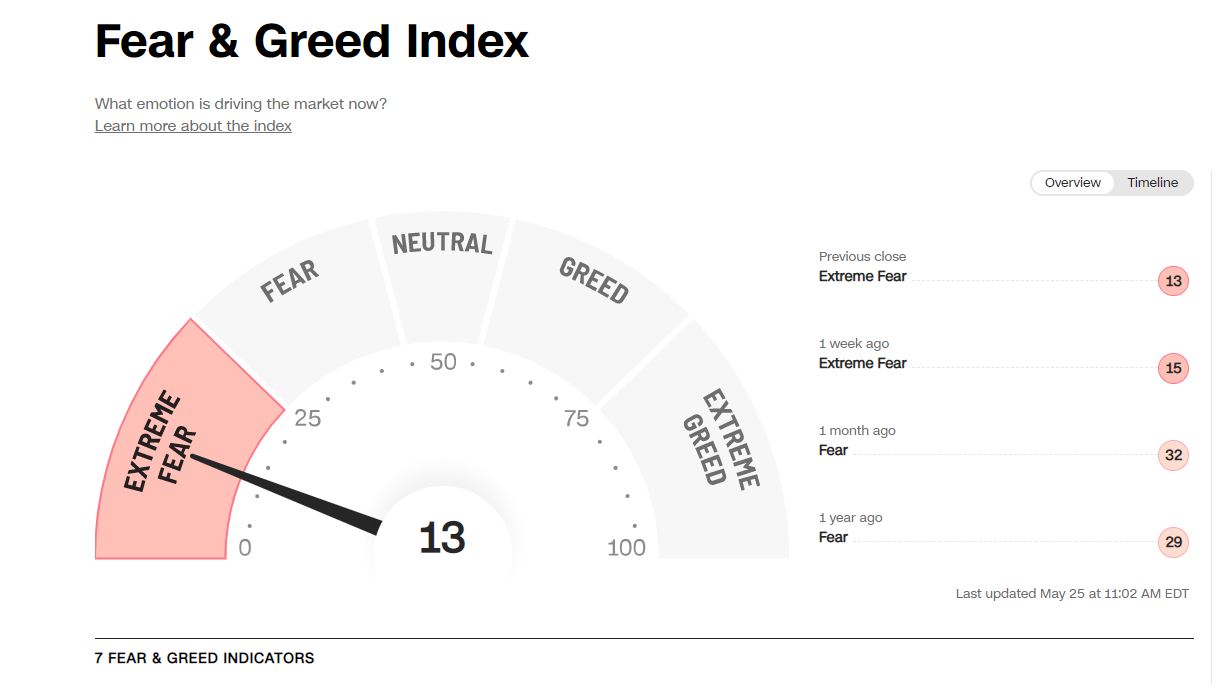

Some gurus today expect a reversal based on the Put/Call ratio and others love this one.

That's CNN Fear & Greed Index.

Either way, those indicators or tools can get pushed to extreme levels for a while.

On the other hand, me...I prefer some math behind my entries.

Small caps have been in trouble 7 times in the last 19 years with drawdowns passing (-25%)

Out of those 7 occurrences, you have 2 cases when we trade (30% to 35%). And it is obvious, that IWM has 2 times traded some nasty (-40%) drawdowns.

What is my point? We have been there and if you want to love the markets and those assets with the potential to make you lots of money, then learn all you can about their behavior, patterns, and price action.

It is no secret I have several algorithms in full surveillance mode and I see on a daily basis lots of trading and investing activity. I work a lot and I embrace the American work ethic. (It makes me proud to be a workaholic)

Once you learn to love an asset any asset you need to have your cash ready to work.

That means you will take short-term opportunities without losing the long-term end game.

Yes, today (May 25) everyone is feeling the uncertainty, but not me. I am feeling my heart pumping because the future is bright. It is only bright when you love something and you know the facts.

When things get ugly or nasty (a word I see many publishers using) then you only thrive when you love something.

No teaser today, I always share things the way they are, no smoke.

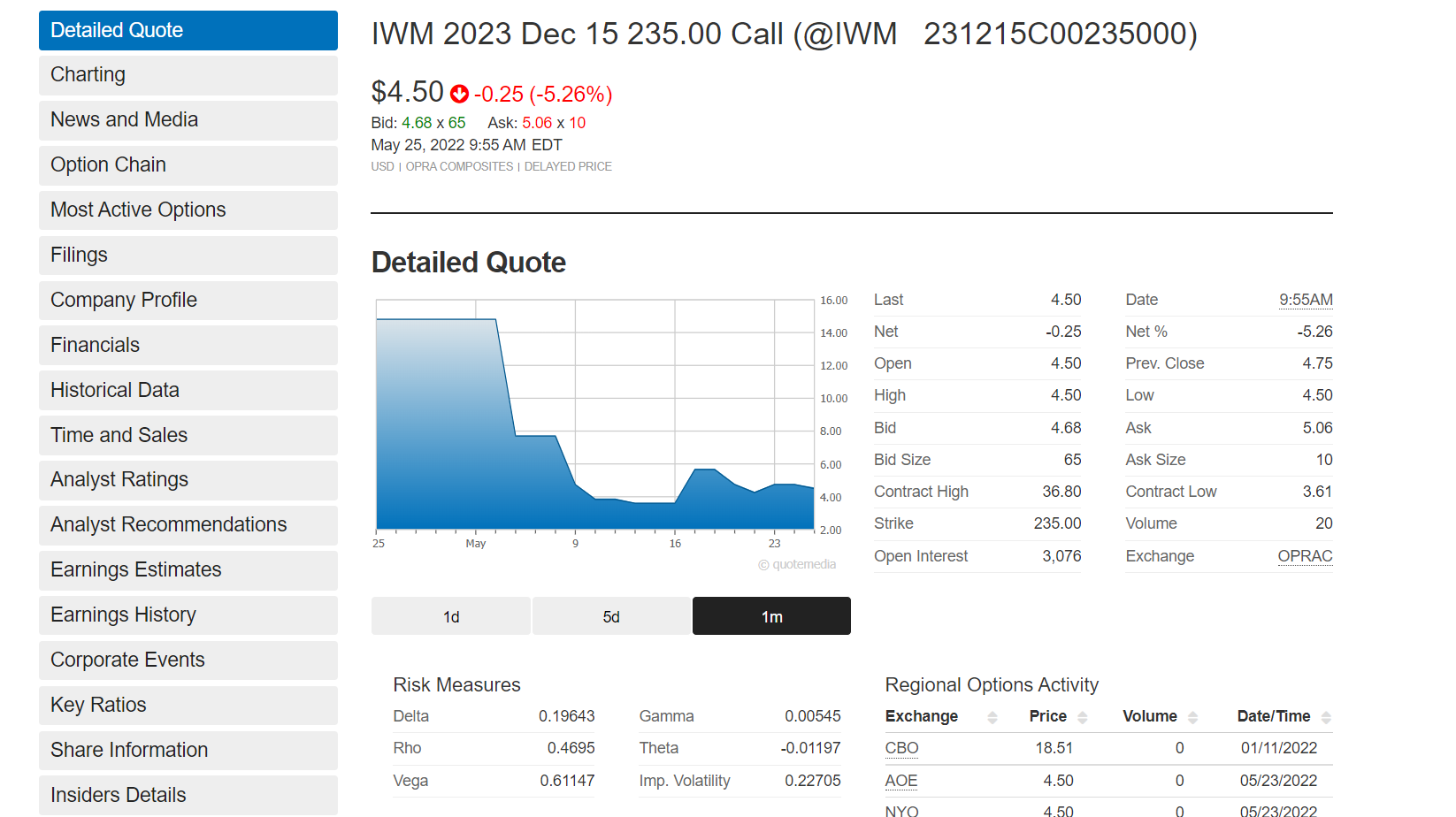

At the beginning of May, someone loaded 769,000 dollars on this particular contract.

As you can see, yes no typo there, it is a long play.

Plenty of time for this to happen 235C until December 15, 2023. (click in the link to get all contract details)

Short-term it all looks crazy, but long term I bet we go back to what indexes do the best; go up.

Love it now and love it tomorrow. We have more than 19 years of evidence.

Until my next post, Never forget

Someone Always Knows