I cannot understand why Americans are not proud of their country. Not sure if they do not like the flag or do not like their national anthem. Still, from discord chats to day-to-day conversations, it seems there is a deep need to focus on those things not working in the country, rather than taking a closer look at the many things Americans do very well.

What do Americans do very well and better than anyone in the world?

American Tech!

You got that one right. No doubt Americanos do not produce 'bricks and mortars' as they used to, but think about it for a minute (maybe three minutes) the United States of America has 330M souls that's a big place with many souls and mouths to feed.

It's not a mistake and the Founding Fathers, smart as they are, adjusted course and built Apple, Microsoft, AMD, Intel, and many others to run and control the world from their own garden without firing one more gun and without anyone having seen nor understanding the great scheme.

They sell you the Smart Phones, they sell you the software and when you have some extra bucks to play with and you dare to think you will make money investing, then (again) they hook you up with the trading platform and sell you the trading tools to buy their own stocks.

Beautiful, Je di Bravo America!

Mike Wilson, Chief U.S. Equity Strategist and Chief Investment Officer for Morgan Stanley, (God Mikey is Chief everywhere) was one of those big-time bears (he has his reasons) so it worked for him and somewhere I read he thinks at some point in 2023 US Equities will accelerate (like they do all the time with enough time).

That's all I have for today.

Need to go back to MSA Live and move some of the risks I have on QQQ and close another position up something like 30% and our community has one more trade this week.

Lord, please! Let Tim Cook come out with some sense and projects that have the potential to move Apple up; Amen.

Never Forget:

Someone Always Knows

You all know who is my publisher and Steve Place is my colleague, still, I get inspiration from a few cracks out there. So I will share those names and views they have on asset classes and market direction.

As usual, I will take care to show you how to eat and execute those ideas.

Today and Tomorrow I think you are better getting all the help you can to be truly successful in the US Equity & Options Markets.

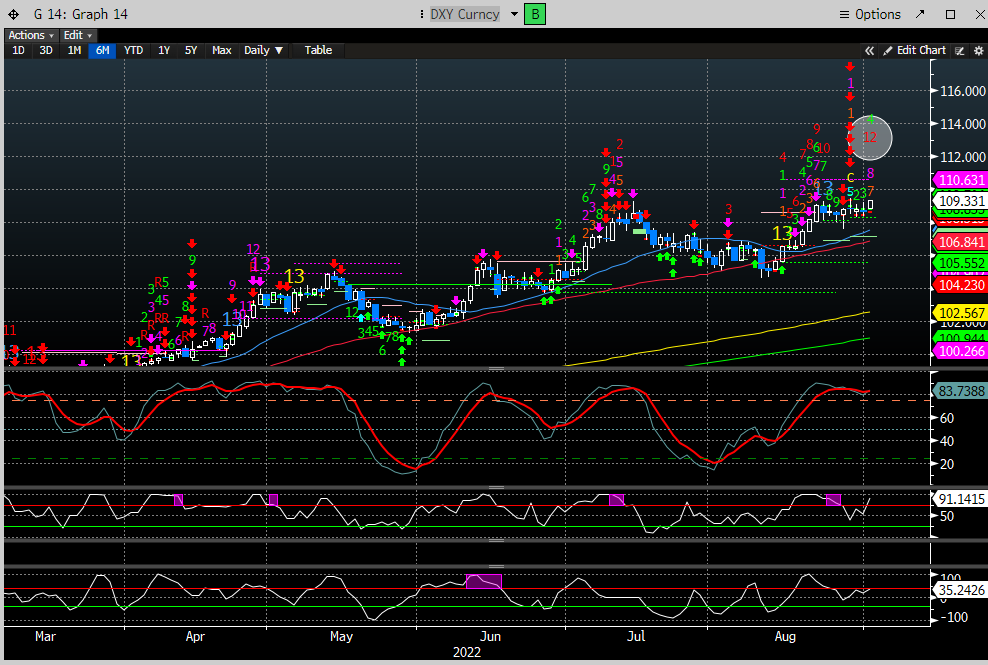

Dollar Index view based on potential DeMark Sequence 13 Sell.

One of the Best, if not the best, for those of you who like to know DeMark strategies, is Coiled Spring Capital. Again, if you are starting the chart might look busy, but it is not.

Let me link his Twitter handle if you want to explore his views. (click the link) Coiled Spring Capital.

Why do we all want to know what's next for the US Dollar?

Because if that thing does not slow down not only it will cripple US Equities returns, but it will activate a massive number of Emerging Market countries' debt defaults, do you remember Sri Lanka?

Yes, all the time, who do we blame first; Covid-19.

I am not sure the virus is the one to blame for the next round of drama.