Summary: Those bears are taking no prisoners, still some bulls are not giving up on the big tech giant and are happy to pick some action on apple's options chain. No secret bonds are not going to do much today, however, out of nowhere someone took the initiative to build a pretty decent position long. This entry took place during the first 15 minutes from the Opening Bell sort of like an early bird.

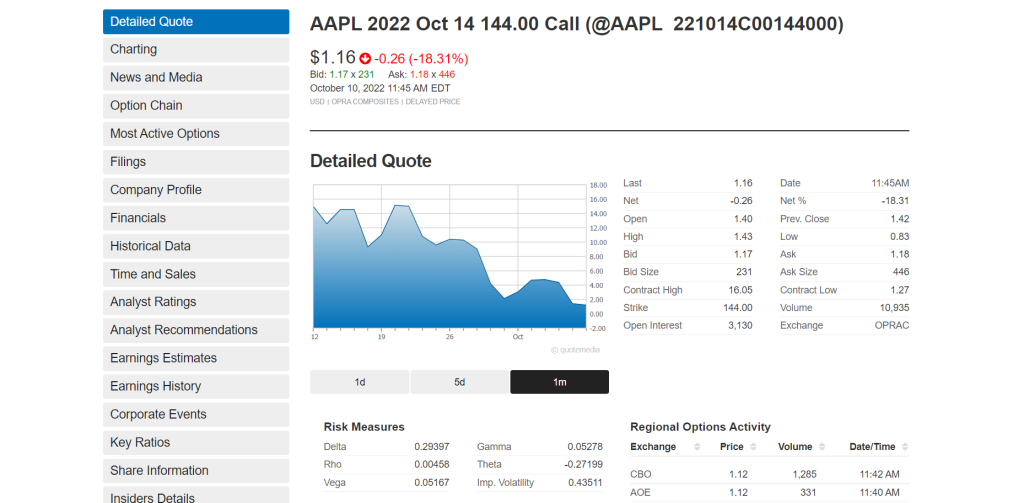

AAPL 2022 Oct 14 144.00 Call (@AAPL 221014C00144000)

As I go ahead and publish this note, the contract low traded at 0.83, and today's high traded at 1.43. It does mean someone had the opportunity to take home 40% for the day.

Someone picked 4,768 contracts against 3,130 contracts in the Open Interest.

Let's go over Apple's technical levels.

I tend to review all the available Apple options for a sense of direction.

However, you can review the broadening range from the beginning of 2022 and it is clear how this stock rotates 54$ from the high to the low and then, 47.50$ from the low to the high.

If you see where the stock trades today, you can pick shares at 78.6% Fibonacci Retracement.

You can now have an idea why anyone would like to bet $500K on Apple options with this weekly expiration.

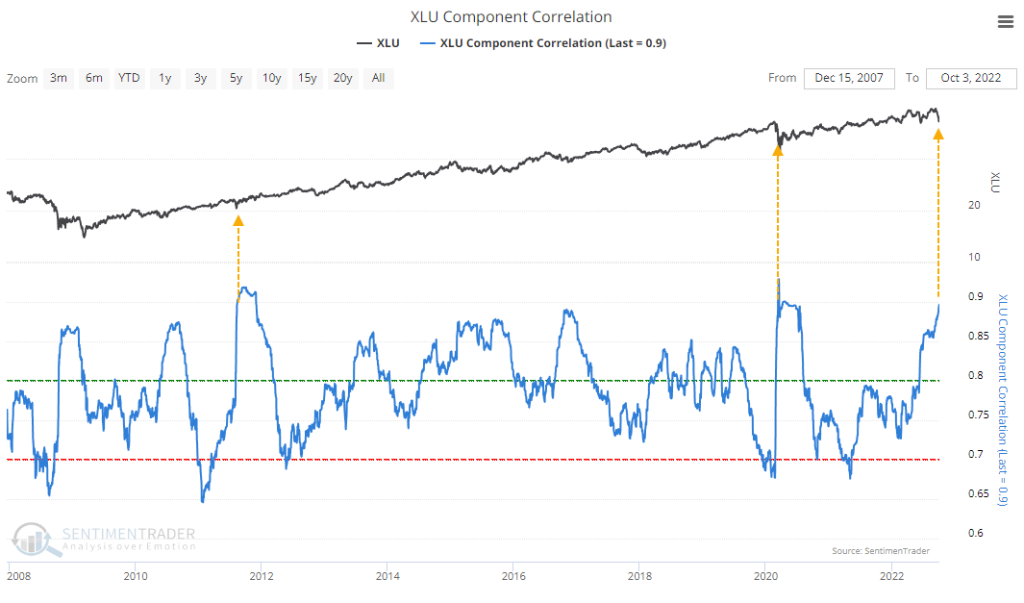

Sentimentrader shares the following chart with this observation:

"When people panic, they sell everything at the same time and correlations spike. The correlation among Utility stocks has just breached +0.90 (out of a scale of -1.0 to +1.0).

That's only happened twice before in 23 years."

As You can imagine many followers dislike the short-term view of such a fact. However, Sentimentraders like any other shop only wants to point to data with some appeals to counterattack all the gloom and doom we get from CNBC or Fox News.

Before I go...

I release my newest webinar with Steve Place.

His interview is the stage I need to explain what, how, and why I do what I do when it comes to Surveillance Capitalism. I think you will enjoy it and learn a few new tricks when it comes to Options Trading.