Summary: another example of Financial Fake News took place more than 15 hours ago when the old good Wall Street Journal published a piece where they broadcasted to the world how Facebook was about to start Large-Scale layoffs.

And if you are a retail trader or if you are a long-term investor:

What do you think you will prepare yourself to do as soon as the market opens today?

Bingo!

You prepare yourself to hit that sell button like there is NO tomorrow in a small effort to recover anything.

On the other hand, day traders will choose weekly Put Options as their weapon to attach the price.

However, nothing like that happens.

(I will explain later)

This is what all those journalists want you to do for the Wall Street Elite, they want you to sell in Panic Mode so they can pick your shares at a massive discount, so later, they can make a profit at your expense.

Take a look yourself...what a disgrace this piece is.

Still, for them is a masterpiece of financial fake news where the media wants to induce the so waited; Panic Sell.

When you read an article from Bloomberg, Wall Street Journal, or even New York Times, look to make sense of the ultimate goal those media outlets have.

They publish headlines structured to sell you on fear and, later, that push the Wall Street Elite narrative.

What's the narrative, you may ask?

One very obvious place false ideas, so retail traders and investors make a dumb move, then they get their hands on your shares (you sold them at a loss), so later, the same Wall Street sharks make money.

If you learn to pick the most basic set of financial fake news, you won't fall for it.

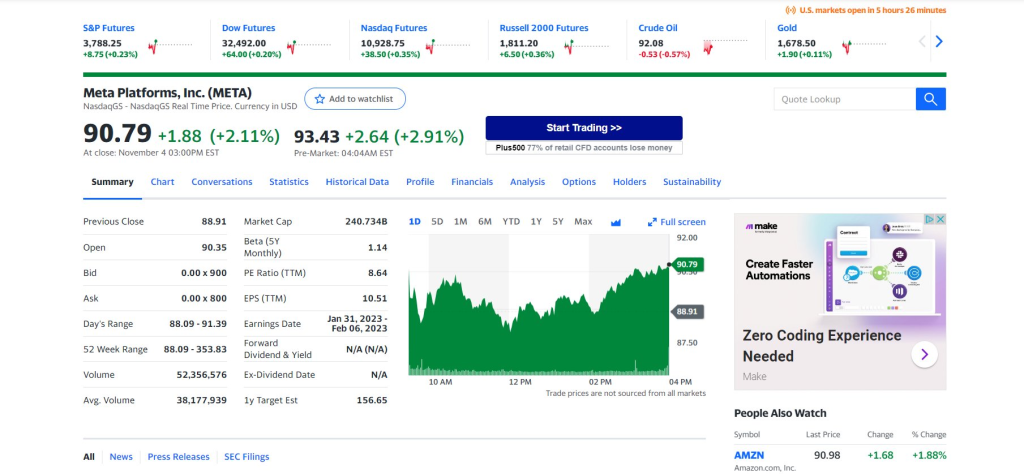

This is Facebook premarket showing you that bad news is now good news for those big players.

The new company path, Meta Platforms, might need some time to work out all the details, but it is far from being a small-cap risky company.

Before I share the plan with you, I have to fight back against Jay Powell and those sharks from Wall Street let me invite you to watch my latest webinar, The Alliance.

In this webinar, you will learn how You can access all the data your in-house algorithms generate to trade the markets better than Bill Ackman or even George Soros.

The Webinar reveals what, how, and why I created this service; watch the webinar now.

You will think the push higher is over; think again!

META 2022 Nov 18 105.00 Call (@META 221118C00105000)

This is the contract I think we all need to trade. It's not too expensive, and it gives us time.

Why am I choosing next week and not the traditional retail trader weekly call?

Because I understand time like no one else. For you and me to have a better chance to make money, we need to buy time. Yes, time is an asset, not the enemy.

The game is not over (yet) for Mark and Facebook.

It's fine, Meta Platforms; after all, the future looks every day a bit brighter.