Summary: If you were to cry like most retail investors during 2022, then you were not listening to the future nor looking to rotate your hard-earned cash. Probably, you were watching Fox News or CNBC without remembering that the stock market (worldwide) works as a mechanism of the future.

What does that mean?

It means you suffer in the now (today) because your portfolio holdings do not do what you want. Note that happens in the now, however, some of those positions might be just too big to deliver the extraordinary returns you wanted in the first place.

Other positions are not in sync with the current economic cycle.

Either way, you must rotate and go where the majority does not want to because they were told not to do it.

Today, I want to share with you where you still have an opportunity to maximize the available capital you have left from the 2022 saga. Yes, although not popular (not yet, give it time) Chinese stocks are primed to deliver what Big American Tech may not do in the next 24 months; jaw-dropping returns on your capital.

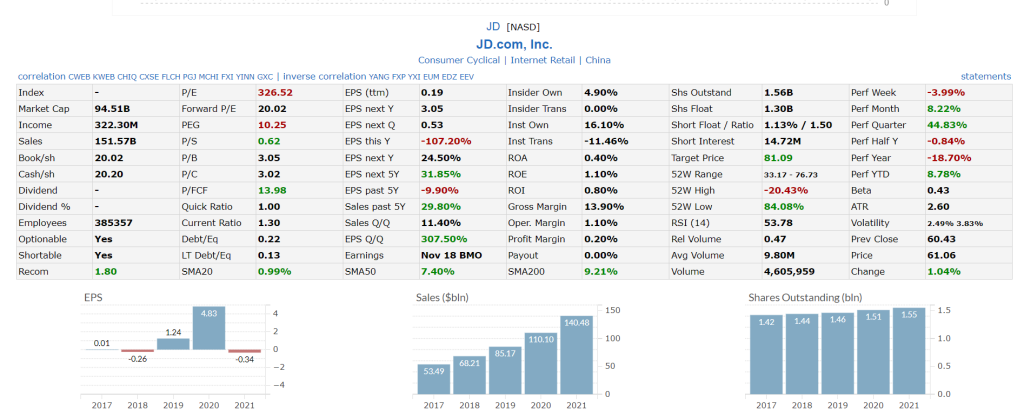

What is JD.com? (according to definitions) the company is consumer cyclical and runs in the Internet Retail industry.

So far so good...

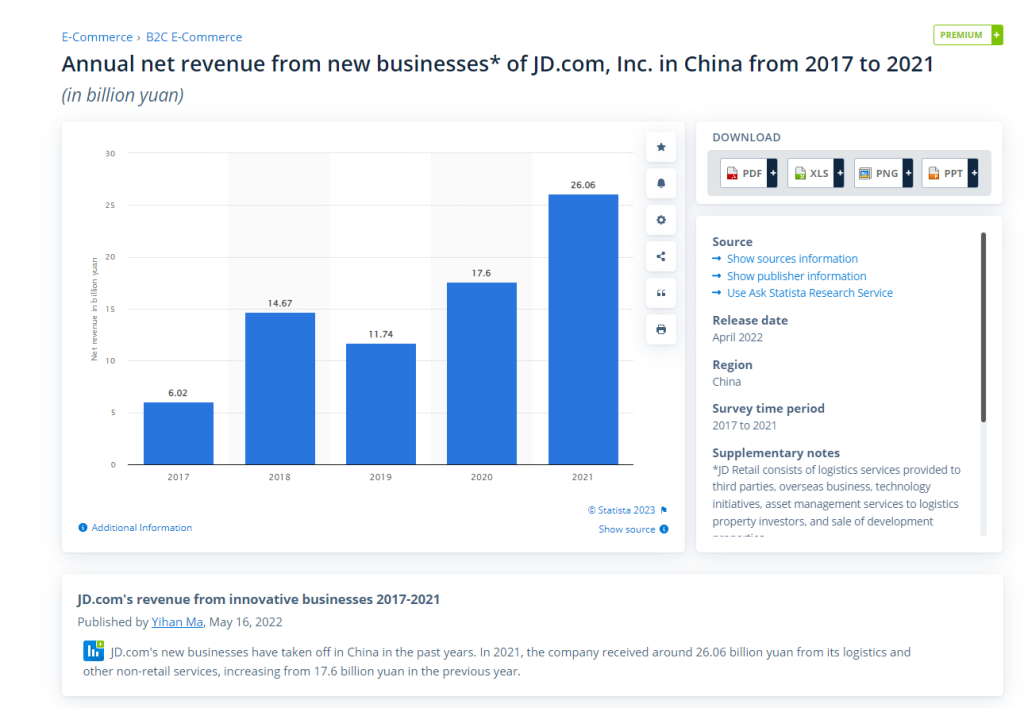

but if you take a look at the Statista chart with JD.com's annual net revenue from new businesses you can quickly come to get the memo; Chinese companies are evolving as fast as they can be in the last 10 years.

I think I do not have to repeat myself, please do yourself a favor and stop watching anything from traditional media outlets in the USA.

The research I produce is pretty simple and goes to give you only the necessary evidence you need to pull the trigger on any idea I publish.

One more thing I want you to consider, not the most critical in this story, but highly relevant.

When you look to stocks that might have the potential to double in 2023 in China, always take one more look at Shares Float.

Why...?

Because it sets the stage for capital to rotate into the stock and make a push higher.

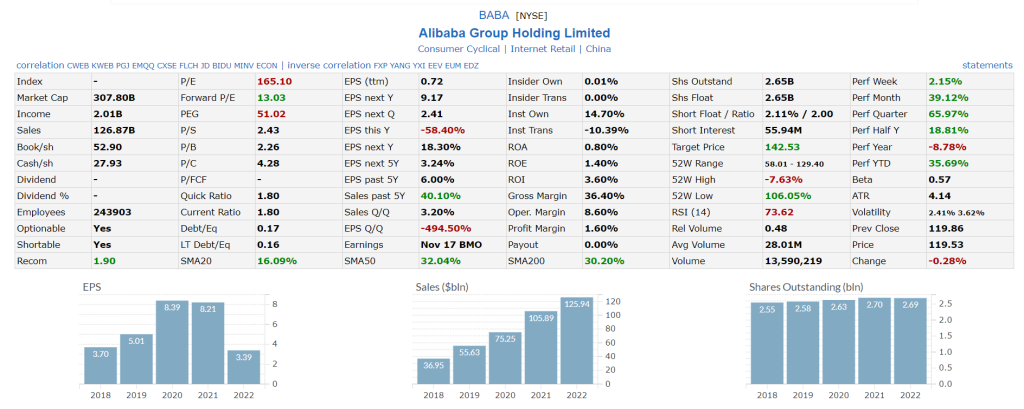

Alibaba has close to 2.65B that's Billions of shares available.

On the other hand, JD.com only has 1.30B; where do you think now you have the best chance?

Chinese stocks are the new normal, American investors just don't know it yet.

They will one way or another.

I am long JD.com loading 20 contracts during this week without paying more than 3.20$ per contract.

The goal is to sell those contracts not too far from 9.60$ and I expect this to take until October 2023.

American Tech will not die, but you should not hold your breath waiting for it to make a grandioso splash in the short term. I encourage you to rotate some of your capital and play the game better than the Big Boys on Wall Street; go long JD.com using 2024 Call Options.