Goldman Sachs Research asserts that breakthroughs in generative artificial intelligence hold the promise of catalyzing transformative shifts in the global economy.

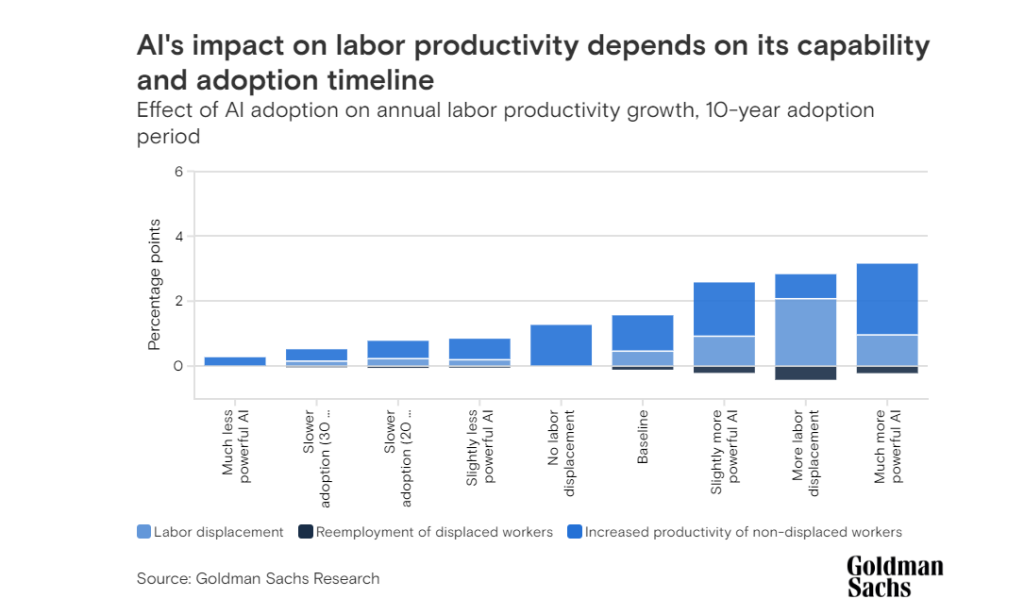

With the advent of tools leveraging advancements in natural language processing, these AI innovations have the potential to unlock a remarkable 7% surge in global GDP, equivalent to nearly $7 trillion, while simultaneously propelling productivity growth by 1.5 percentage points over a decade.

In a report by Goldman Sachs economists Joseph Briggs and Devesh Kodnani, they acknowledge the uncertainties surrounding the full extent of generative AI's capabilities. However, they underscore the profound implications of this technology's capacity to produce content that is virtually indistinguishable from human-created output and its ability to bridge the communication divide between humans and machines. This remarkable advancement is poised to have far-reaching macroeconomic effects, capable of reshaping industries and societies.

About Goldman Sachs

Goldman Sachs traces its roots back to 1869 when German immigrant Marcus Goldman established a small commercial paper business in New York City. Over time, the company steadily grew in prominence, fueled by its commitment to integrity, client service, and innovation. Through mergers, acquisitions, and strategic partnerships, Goldman Sachs expanded its reach, establishing itself as a formidable force in investment banking.

At the crux of Goldman Sachs' success lies its uncanny ability to navigate treacherous waters, thriving even in the face of adversity. The firm's resilience was tested during the tumultuous financial crises that have plagued the world in recent decades. As the global economy buckled under the weight of the 2008 financial meltdown, Goldman Sachs emerged as a triumphant survivor, its strategic foresight and professional risk management shielding it from the worst of the storm.

While competitors faltered, Goldman Sachs showcased an unparalleled ability to seize opportunities amidst the chaos, leveraging its vast resources and intricate knowledge of the markets to emerge more vital than ever.

Yet, Goldman Sachs' triumphs have not been without scrutiny. Critics argue that the bank has been marred by ethical quandaries, with accusations ranging from conflicts of interest to the perception of excessive influence over governmental affairs. The revolving door between Goldman Sachs and critical positions in the halls of power has raised eyebrows, fueling skepticism about the system's fairness and raising questions about the true nature of the bank's involvement in shaping policy.