Traders often succumb to their pride, disregarding their trade plan. The desire to be right is inherent in human nature, but it is not a viable approach to trading.

Once you have formulated a trading plan, it is crucial to adhere to it strictly. Deviating from your project will only lead to inconsistency and considerable pain.

To avoid such pain, write down your trade plan, keep it in front of you, and never deviate from your established rules.

I have been following this practice for approximately twelve years. Despite occasionally feeling the urge to develop an opinion and try to predict the market, I have learned that doing so only results in financial losses. It serves as a reminder to stay committed to my plan. The market swiftly takes away thousands of dollars, reminding me of an unpleasant feeling I strive to avoid.

Regardless of the specifics of your plan, if you fail to adhere to it, you will not achieve long-term profitability—I can assure you of that without a doubt!

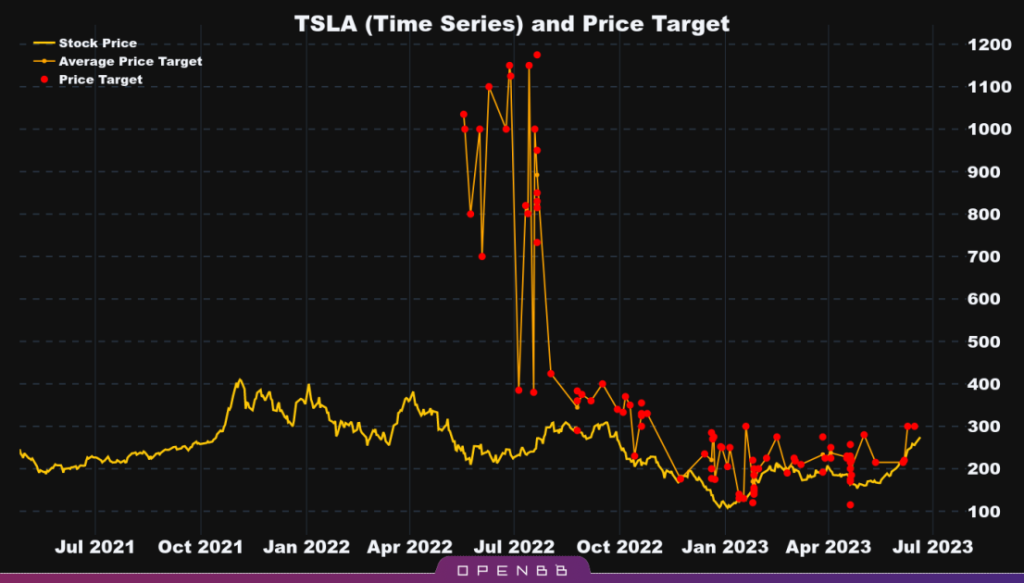

We find ourselves amid the most anticipated recession of our lifetime. Market manipulation sustains artificially inflated conditions while soaring living costs have made it unattainable for many to maintain a decent quality of life.

The triggering event for the impending crisis remains uncertain, but when it unfolds, it is likely to be severe. Perhaps it will be the collapse of the US dollar, or maybe it will involve further bank failures.

As time progresses, the truth will reveal itself, as it always does. Nevertheless, regardless of what transpires, I will continue trading for my benefit and assisting others in achieving excellence in their endeavors.

If you’d like to learn more about how you can join me in helping others on their path to wealth, click here…

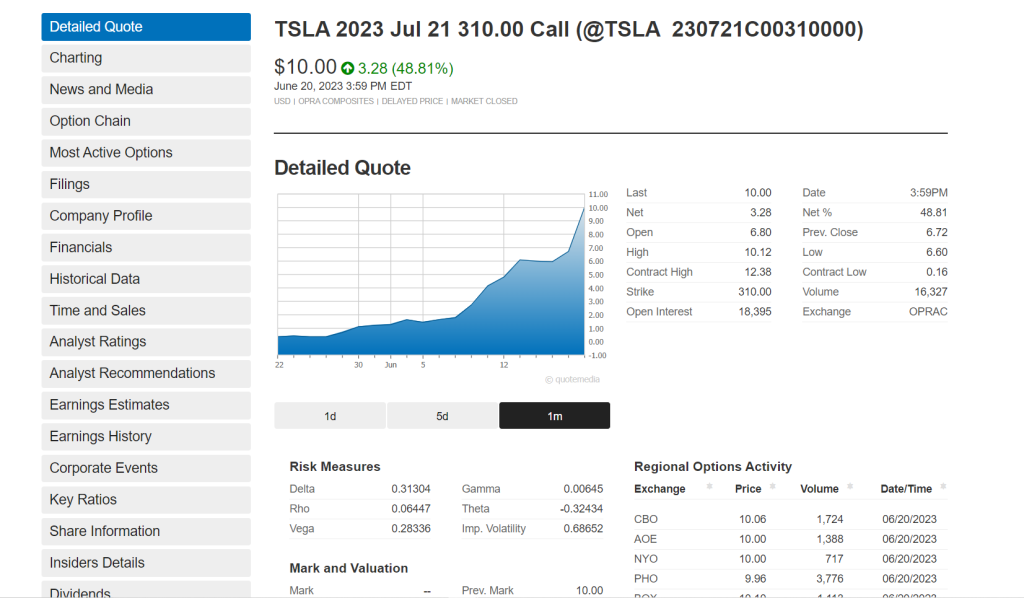

One of the most enticing advantages of options trading is the potential for leverage. With a smaller upfront investment, you can control a more significant number of shares, amplifying your gains. This allows you to make the most out of market opportunities and maximize your return on investment.

Another critical benefit of options is profit in any market direction. Whether the market is bullish, bearish, or stagnant, options give you the tools to adapt and capitalize on the situation. You can employ strategies such as buying calls or puts, writing covered calls, or utilizing spreads to align with your market outlook and profit from upward and downward movements.

Risk management is paramount in trading, and options provide valuable risk mitigation tools. Using options strategies like stop-loss orders, protective puts, or collars, you can limit your downside risk and protect your portfolio from significant losses. This added layer of protection ensures peace of mind and allows you to navigate volatile markets confidently.