Summary: the storyline has not changed much regarding interest rates and where we see the Federal Reserve hiking. However, you don't need to surrender to Jay Powell's mandate because you can always fight back. I find it beyond disgusting how the day-to-day American sits down and decides not to do anything in his power to fight back.

I always show up for work and keep pulling my little box, and I feel you should do the same.

Now, you don't need to pull in the same direction everyone does; that's why I have been tracking all the data I can from China.

Yes, Chinese stocks are not death. Those are going through a cycle, and that's the opportunity you and I want. It is a very simple process, go and look to invest where no one wants to.

I will give you some evidence so you walk away from this article with an idea of the returns you can expect from me in less than 24 hours; this is not a typo.

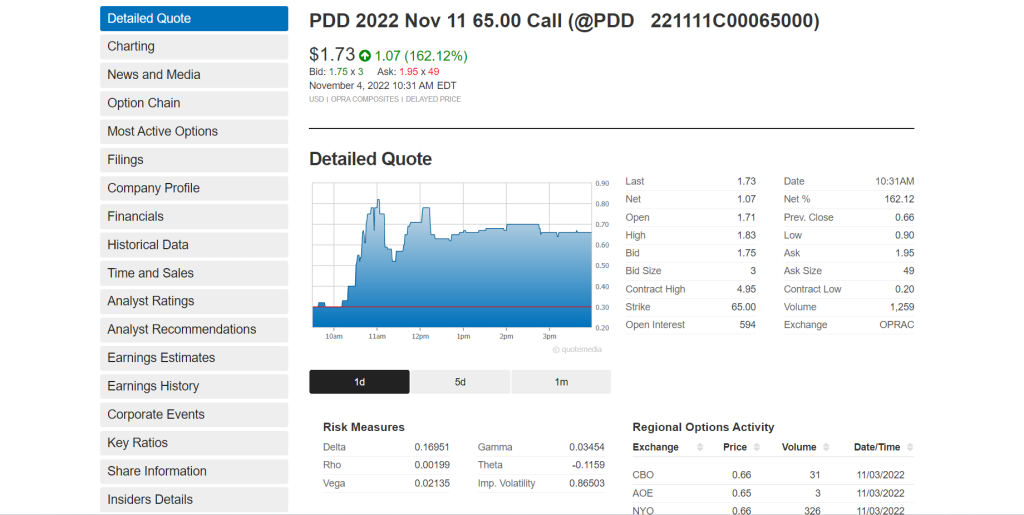

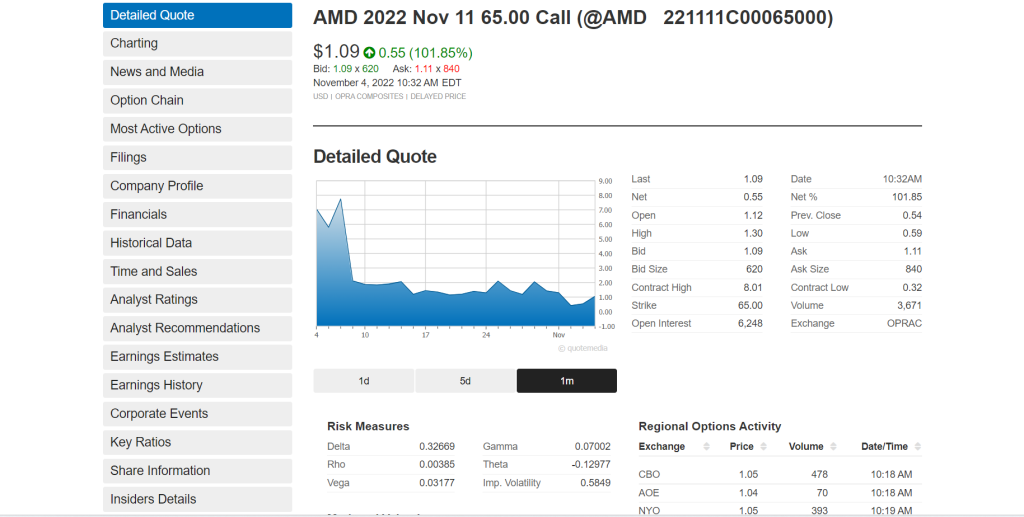

The following returns took place in less than 24 hours.

Still, how did I know it was the best time to trade PDD the best part, it is time to buy a Call Option. After all, we are supposed to be in a recession, so stocks should not go up that much.

The answer is simple.

At The Alliance, we have our in-house algorithms spying on the Wall Street Elite and tracking everything they do and say, just as the big tech players like Amazon, Facebook, and Google do on all of us.

I figured out a way to turn the tables and track them.

You do not need to predict anything when you can access the best data in town to apply Surveillance Capitalism.

And the same data let us pair our trades; Chinese stocks can go with another set of companies no analysts expect to move up either; semiconductors, in this case, AMD.

These two trades are still running, and I have already sent out another play for our members in 'The Alliance' to ensure they can fight back and protect their portfolios today and tomorrow.

It does not matter if the FED decides to break the US and World economies.

Our in-house trading algorithms got your back.

If you are wondering how YOU can take action today and be part of a group where individuals from all over the world are not taking it and rather pick the tools to 'Fight Back' the Fed, Vladimir Putin, and any other lunatic out there pushing hard to hurt their wealth, then you want to watch my latest webinar.

It is an opportunity for me to explain what, why and how I do what I do for hardworking people like you in the effort to save you from the Fed; watch the webinar about the market Surveillance Alliance.

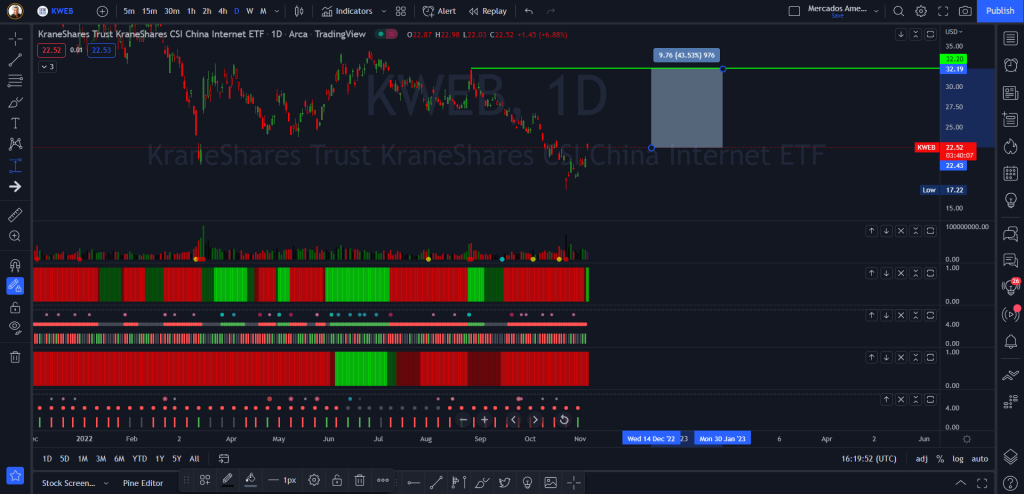

Let's think you are hunting for one opportunity to trade and make some money from today to July 2023, then I have what you need.

When it comes to Chinese stocks, if you do not have the tools we have at The Alliance, then pick KWEB this ETF will make it easier for you to have the necessary exposure when the markets turn around.

If you have comments or questions, feel free to contact me, and don't forget to watch the webinar.