If you have a family member or any of your neighbors who work at Spirit Airlines, can you please do me a favor?: What the hell is going on at Spirit's HQ?

I have NO idea the game plan the company has to survive without joining forces or being acquired.

Alright, the company has 17 dollars in book value (they have value) and something like 12 dollars in cash per share.

It is not the 59 dollars in cash per share United Airlines has, still JBLU is an attractive play.

And yes, CNBC has to come up with its own piece on the matter.

Let's start with the investment play

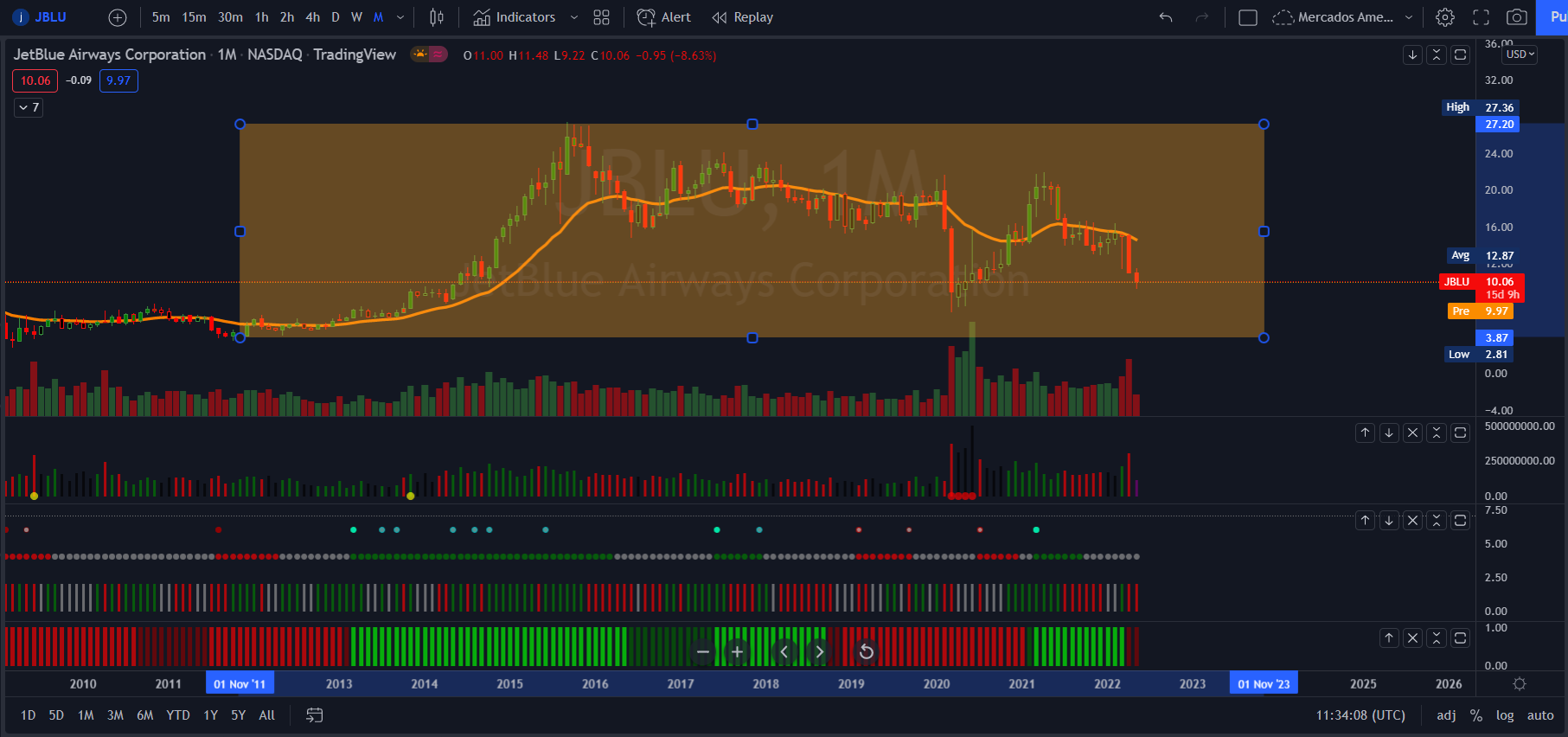

No doubt United Airlines has more cash, still, I think based on the Price Rotation for Jet Blue there is more juice I can squeeze.

Price Rotation goes from 4.11$ per share going back to November 2011 all the way up to 27$ per share in September 2015.

Today I see a conservative 50% upside and the rest all the way to 100% is a bonus.

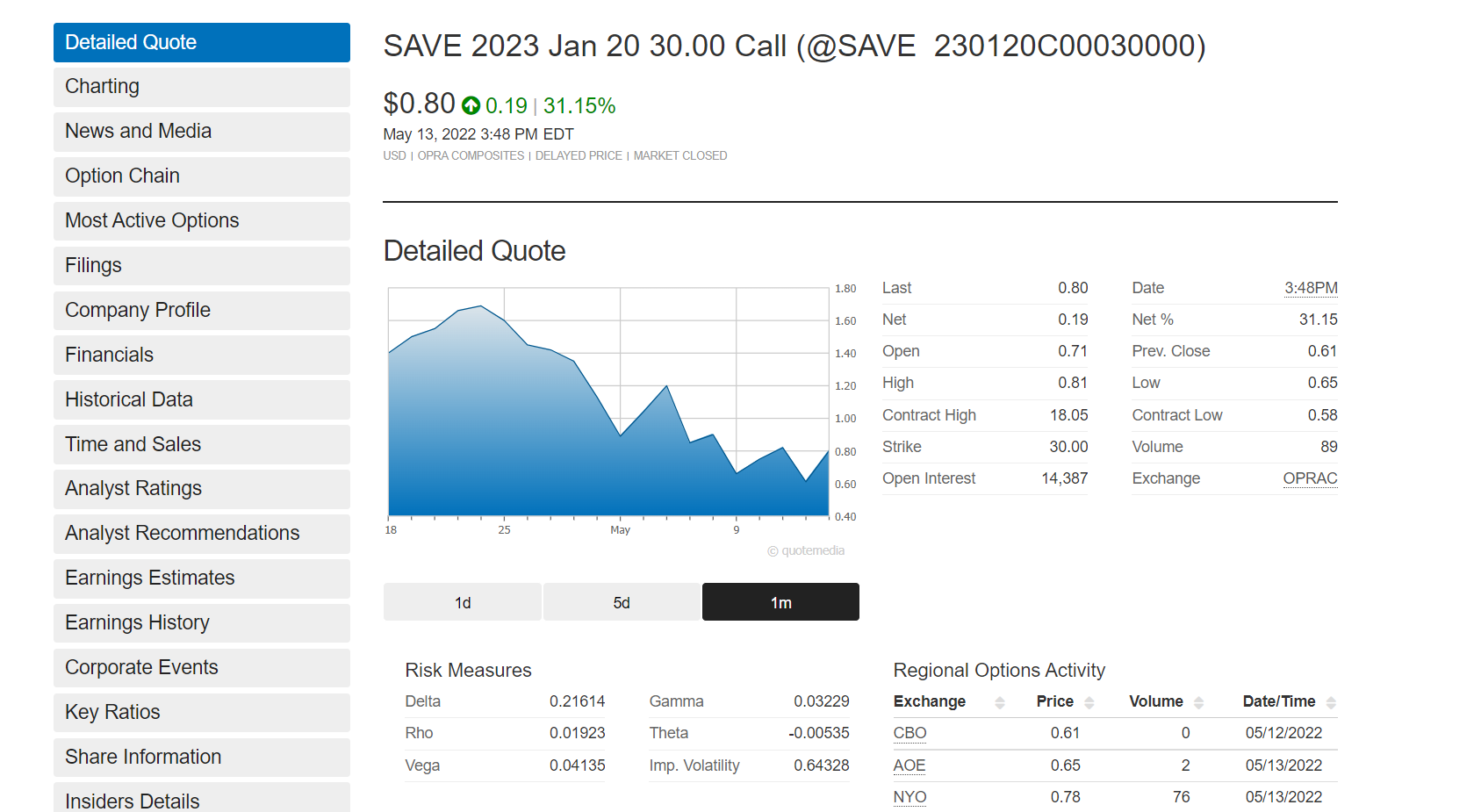

On the other hand, take a look at this Option Contract for Spirit Airlines.

It has some strong activity back on April 6 of this year.

It took them the whole day, but they loaded 242,000 dollars at a price per contract from 1.11$ to 2.29$.

You can get them today at 0.80 cents on a dollar. Let's see how they open today.

FYI on May 16, 2022, Spirit Airlines opened at 16.90 dollars per share and traded as high as 18.83$ per share. In the first 30 minutes, the stock registered close to 8.5M shares traded.

Basically, any short-term trading has to focus on SAVE and not on JetBlue.

You can always check on Quotemedia to track the contract progress.

Let me keep all the algorithms running until I spot something valuable for us.

I will write more about them later.

If you stop and think about it for a minute, JetBlue is doing the right thing by forcing Spirit Airlines to let go of the current structure.

You can always come back to our Blog for more ideas for you to pick potential investments and trading ideas.