Today's story has three parts.

Part 1: Mike Wilson either gets like $1M bonus by the end of the year or he might as well pick his client's book and walk the doors at J.P. Morgan.

The man called most bearish rotations and seems to be ready to call a bottom in 2023.

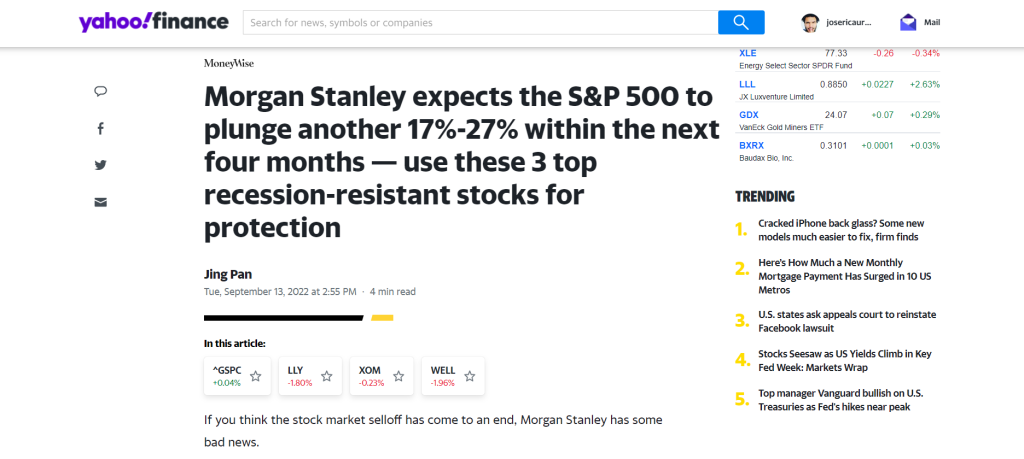

Take a look at last week's headlines on Yahoo Finance.

Is that something new? It's not different from the many guests at CNBC talking the market all the way to 3.000 or even Michael Burry's SP500 2.000 points target.

Everyone talks about their books and best plays. Never forget that.

One of the questions many investors think about is this one:

Who is buying US equities? I have to think women (they found new wealth and believe in the markets), you have Insiders (Form 4. You can ask Steve Place about it), and Asset Managers with plenty of cash, probably more cash on hand than in 2008.

And I am positive anyone who knows and understands basic history is and will be buying US Equities.

Why...?

Because the math is exact; every single crisis and market disaster ends with a new All-Time-Highs.

What was that? Oh, you are wondering when it happens...

It happens over time.

It's part of the economic cycle.

Part 2: Morgan Stanley's bearish targets are not new and nothing you couldn't figure out on your own.

See the chart above.

If you go back in time to late 2020, it took four months to base before any meaningful push higher took place.

Burry's bearish target at 2,000 is attractive and I am sure many will die for it because it will translate into the Buy the Dip of the Century, still is far from making sense.

And finally; Part 3: When you hear from me: Fight the Fed (my 2022 and 2023 hashtag) it is not about going against the Fed, it is about fighting them to protect your IRA or IRA Roth or simple as to protect your investment account.

Believe it or not some investors can run 30% to 40% drawdowns (yes, they do and even deeper drawdowns) still, if you are willing to do that, you might as well learn how to trade options and make sense of them to offset short-term losses.

Today's video cover one ETF that anyone willing to fight the Fed can use to potentially make money and pick a few dollars while you see this bearish rotation expand.

It's the same game plan every day. We will show up and wait for juicy signals our MSA Algorithms will generate for us to fight the Fed and follow the Wall Street Elite.

This is NO time for you to throw the Towel.

The business has been running for more than 200 years and as long as Americans are around, then we will have a business to play.

America 1st

If you made it this far you may want to jump and watch the first training I recorded with Steve Place about the Market Surveillance Alliance go back and click on Market Surveillance Alliance.

Never (ever) Forget:

Someone 'Always' Knows

J.R. Jaén