Yesterday before the Closing Bell all seemed lost. No one has a clue what to do next, still never forget someone is ready and knows the tape better than you, me, and any woman or man with a Harvard MBA.

Today was one of those days we all needed something to look forward to.

Why...?

Because never forget, it is easier to make money in bull markets, than in bearish markets. It is human nature to hit easily the buy button, however, if you want to make them start with Sell, you are going to have a hard time teaching the average Joe and Jane the art of short selling. I bet my life on it.

And so far so good, it seems we got the miracle needed to tame the Fed (or so we think).

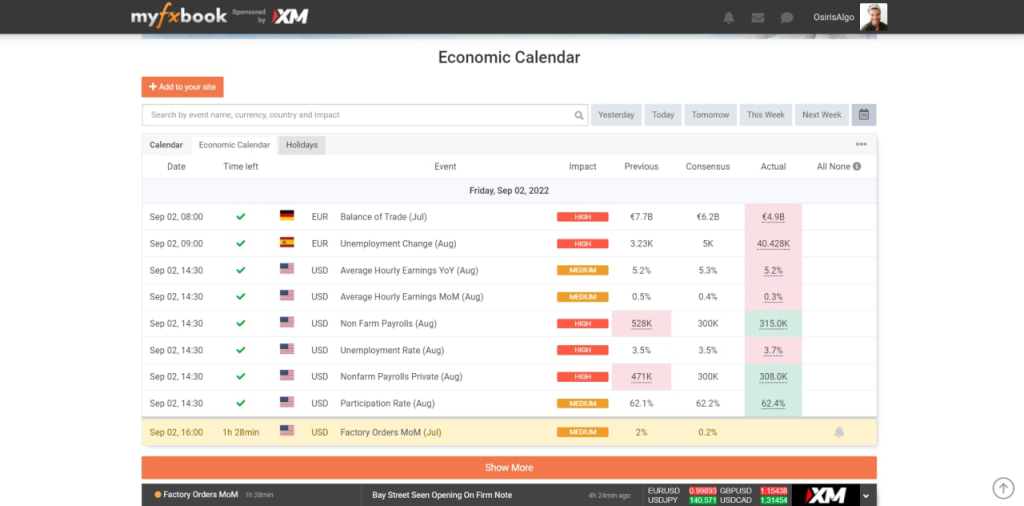

The infamous NFP, Nonfarm Payroll, came a bit above consensus and prints a 315K figure not too far from that 300K expected.

The real kicker is a previous print that was a sweet 528K, long story short, that is a massive drop and sadly such a reading is positive for the stock market.

The Fed induce recession seems to blossom as you read my ideas.

Let's keep it short for today and keep an eye on our MSA YouTube channel for more ideas, setups, and market structure.

If the bottom is in place (as Sentimentrader suggests) then Netflix is not going to have a bad end in 2022 and the stock can easily make a move to cover some of the previous bearish Gap.

If I were to pick a new EOY target for the former pound-for-pound 'Streaming Wars' King that would be 300$ per share. If you think about it, not difficult at all as it is an initial attempt to seriously close the bearish gap and it does not mean Netflix is a strong conviction buy.

At least, it will open the door for us to make money to the upside.

How does Netflix make it all the way up to such a fancy target?

Well, the same way the SPY crushes bears into EOY, having the VIX breakdown 19.70 which it already touched a couple of times and that level is NO stranger to the volatility index.

How so...?

Because that is part of the market memory and all that bottom liquidity is stuck down there. Go to your chart and scan the daily chart on April 21, 2022.

Do you see that? That's my point.