What if we don't own enough Bitcoin? Overcoming the Bitcoin Challenge.

Have you considered the potential consequences of insufficient Bitcoin in your portfolio? What if BTC regains its trading position above the lows witnessed during the summer of 2021? Understanding the risks associated with the Bitcoin Challenge and the importance of owning enough Bitcoin is crucial.

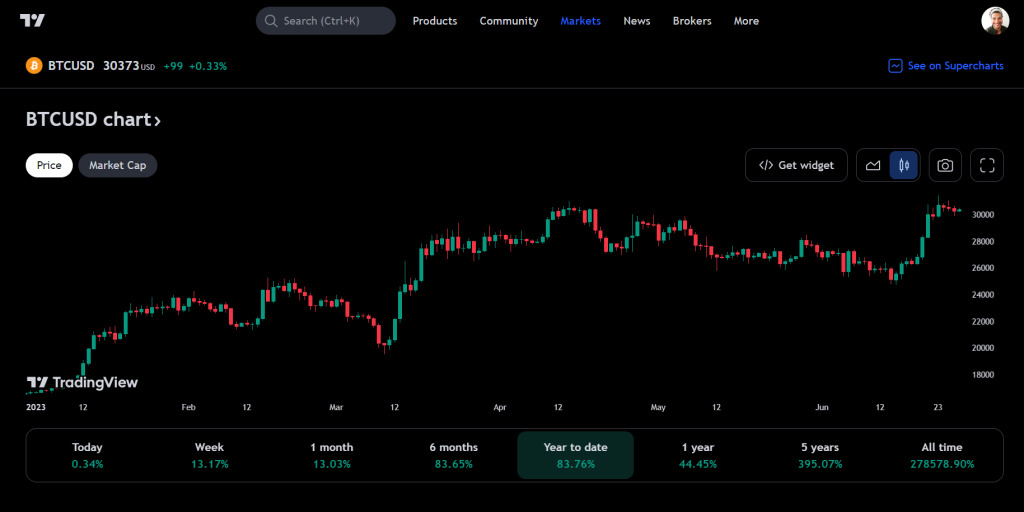

The chart below depicts the transformation of the support levels observed throughout 2021 into resistance levels in 2023, highlighting the ongoing Bitcoin Challenge:

Year-to-date 83,76% (when Bitcoin trades at $30,363 or higher)

But for how long will this challenge persist? How quickly can Bitcoin rally back toward the $60,000 to $65,000 range? And if it surpasses those levels, what are the chances it won't stop there? How far beyond $60,000 to $65,000 can Bitcoin soar? These are the critical questions that demand our attention and preparedness.

I often contemplate my exposure to Bitcoin and whether it is sufficient to meet the Bitcoin Challenge. These decisions, however, are personal and unique to each individual. If Bitcoin surpasses the $31,000 mark, it indicates that I don't own enough. The real risk lies not in Bitcoin reclaiming $60,000 to $65,000 but in its potential to surpass those levels and reach new heights, such as $100,000 and potentially even $120,000.

It's worth considering Bitcoin's historical performance, where its value surged by a factor of 20 over a few years from the end of 2018 to 2021. As a point of reference, a 20-fold increase from the recent lows would propel Bitcoin beyond $300,000. While such milestones are within reach, it's important to note that Bitcoin doesn't need to reach those specific price points in this cycle to generate significant returns.

If you look closer, then Inverse Fibonacci takes us to $134,000 as soon as January 2025

Personally, I remain bullish on Bitcoin and maintain an extended position. However, if we surpass the April highs, I believe it's essential to be exceptionally bullish in tackling the Bitcoin Challenge.

I'm curious to know how you are approaching and navigating the Bitcoin Challenge in this current situation.