Summary: if you like the idea or not, it does not matter because US Stocks are the only game in town. You are to accept the undeniable truth; more and more countries are trading US Stocks for a living, and mark my words; Options on US Stocks too. You probably think it is a joke; after all, for those who know little about American greatness, it looks like a massive Blackjack or Poker table, but I am 1,007% you think it is a casino, but if I were you, I wouldn't hold my breath on the latter.

Let me share a bit from a piece Nikkei Asia published this weekend.

I think I do not have to expand too much on the subject.

What are the reasons for the Japanese market to slowly (it took decades) leave behind Japan's domestic market and risk crossing the Pacific to target US Stocks?

Let's see...

Everyone is now All-In, and it sometimes feels like everyone except Americans.

Not much to do in that case. I think someone else's will eat their lunch if they do not fight for it.

I know that's not your case if you read my blog post. So, you are good.

According to Nikkei Asia, this seems to be the way things are developing (or developed) in Japan:

The key factor behind the shift is demographic. The share of people aged 70 or older in the overall population rose from 10% in 1989 to 26% in 2019. But the aging of shareholders in Japanese stocks has been even faster, with the ratio of investors in their 70s and older rising from 15% to 41%. This is mostly because younger people are avoiding Japanese stocks and putting their money elsewhere. As foreign and institutional investors bought shares sold by elderly shareholders, the overall ratio of retail investors in Japanese stocks has fallen.

Nikkei Asia

Original article by Yosuke Kawaji and Kensuke Yuasa

If you may, please write down that word; demographic. It answers many cycles you know and probably experienced in your lifetime.

Do you remember those Babyboomers? Yes, Bill Clinton is one of them.

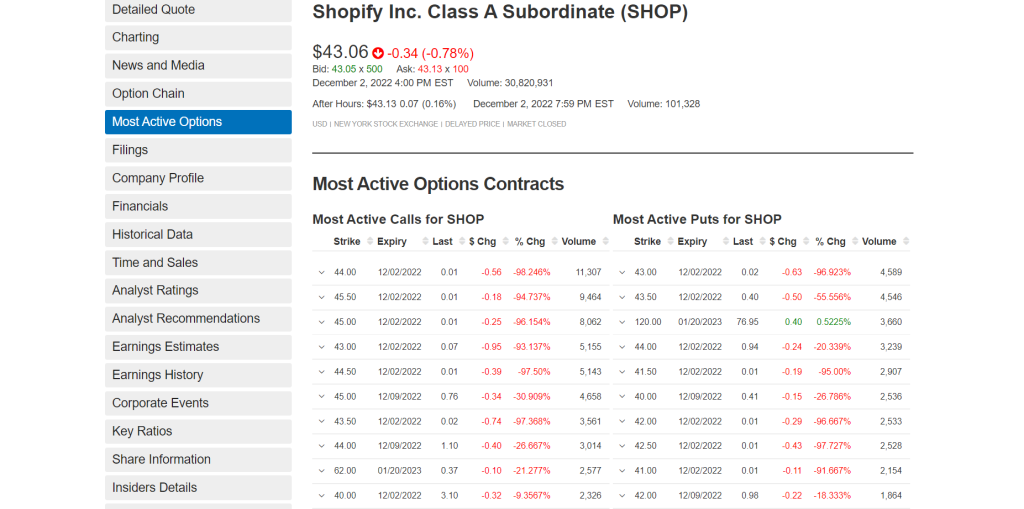

When I hunt for the next opportunity, I use quotemedia to sense where everyone is or where "someone" might be making a move. This site is where I started, and it is easy and a good step for anyone to start trading options on US Stocks.

I can see 44C has some decent volume activity, and the stock closed at 43.06$ per share.

That makes sense, and you can pick contracts not too far from 1.10 premium.

However, let me look closely at Shopify's current chart structure using Hawkeye Traders tools.

Do you see that big green dot at the bottom indicator? You do...?

Excellent, then that's Roadkill on a 1W (1 week) configuration, meaning we have a solid signal to go long the stock short and medium-term.

Last week's stock performance was stellar, with a strong +21.53%, which added close to 7.95 to its price, but what does that mean for you?

It means you can probably go higher when picking your strike price.

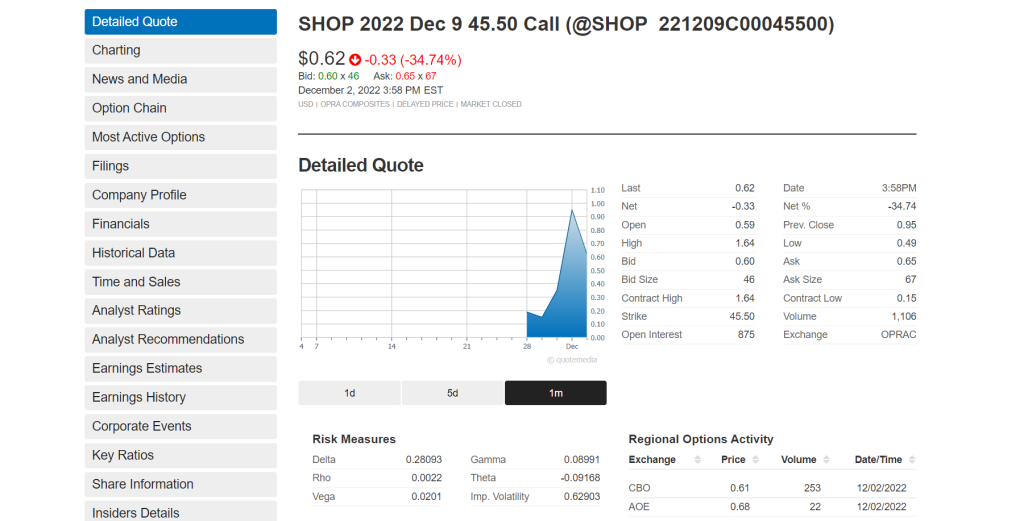

Let me guide you, and let's go now with SHOP 2022 Dec 9 45.50 Call

As you can see, the volume is 1,106 contracts versus 875 in the Open Interest.

Not a massive capital rotation, but it is still worth the opportunity.

Are ex-US Stocks doing good? Not sure Shopify or even Alibaba (above) qualify in that structure. I honestly have to double-check.

One thing is 1,007% the truth; while Apple struggles, you can tell other market components are doing very well.

Is that the ultimate evidence about the world embracing US Stocks more than Americans (Shopify is a Canadian e-commerce company listed on US soil)?

Time will tell, and if that's the case, You need to know precisely where the action is taking place, so it is a great moment for you to watch >>my webinar now<< and learn how, why and what I do at; The Alliance.

And don't forget; the whole world is watching!