Everyone is bearish...like really bearish, almost writing a letter to Santa Claus to get a recession.

And that's why the so-called 'Recession' is avoiding us (at least for now).

Also, another scenario is where the recession started and who it tackled first; Tech companies.

Those making $150K felt the pain for the first time, and I think good or bad Elon Musk is part of the answer.

The man walked into that Twitter office, then scrambled the organization and fried a bunch of losers to save the platform, which now seemed positioned to have a fighting chance.

True...

I cannot deny Elon's antics are not 100% drama free, and some "good" people lost their job.

However...

If you play hard and drink Kombucha, you must be ready for a rainy day.

Please, do not feel sorry for them; they party until the music is abruptly interrupted by Elon Musk and the massive wave of failures in the so-called: Metaverse (not even God knows what that is about).

Let me free you pretty fast...

Allow me to explain the why in three basic charts.

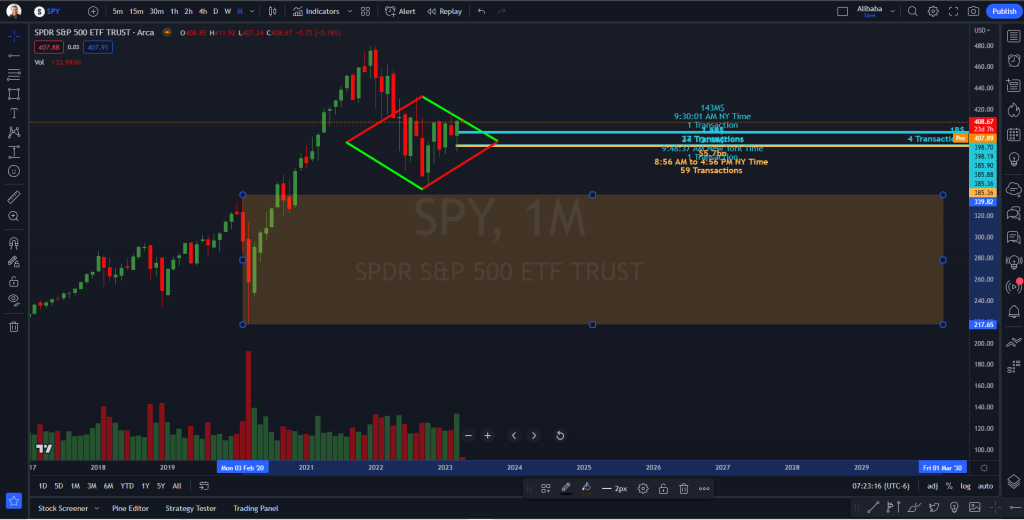

No. 1-Covid Block Structure

It means you have a massive wall preventing the index from walking into a lower trading frame under 340$ per share. If you think twice, October lows traded at 348.11$

Now you know why that's our market bottom in 2022 and can easily be a tradable bottom for another year to 24 months.

No. 2-Continuation Diamond: Where to go from there?

Now it does make sense, right?

Welcome to 'Continuation Diamond'; you may think this is the one, and the recession is around the corner; ready to be surprised?

This is not your bearish pattern (not yet).

The market started a bottoming process in October 2022, and for the last 5 months, the price action keeps rejecting anything under 4,000 points.

FYI, this one is about to break to the upside.

And as you can imagine, many people will be outraged because they have NO equity exposure.

And finally...

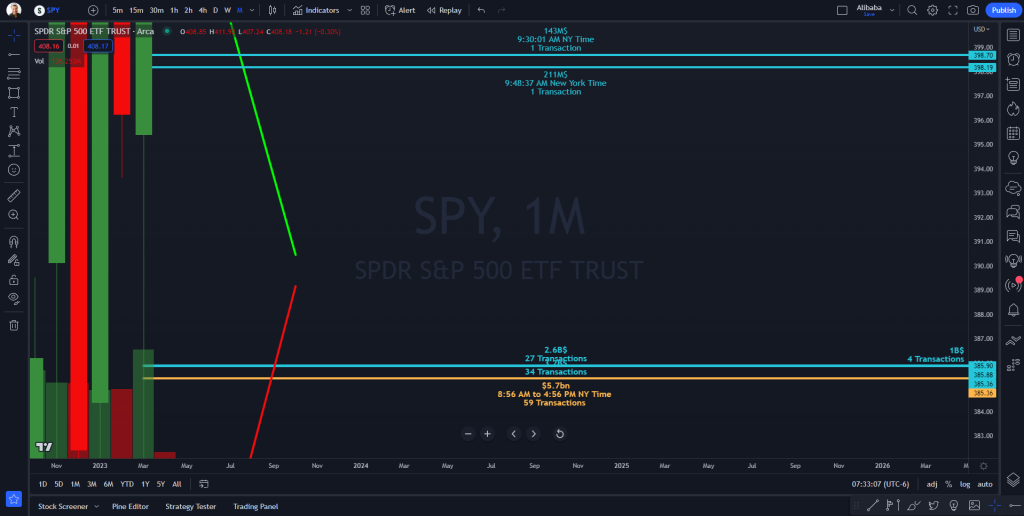

No. 3-The Legendary Darkpools

So, I am positive you knew about Dark Pools, darkpools, and THE darkpools; did you?

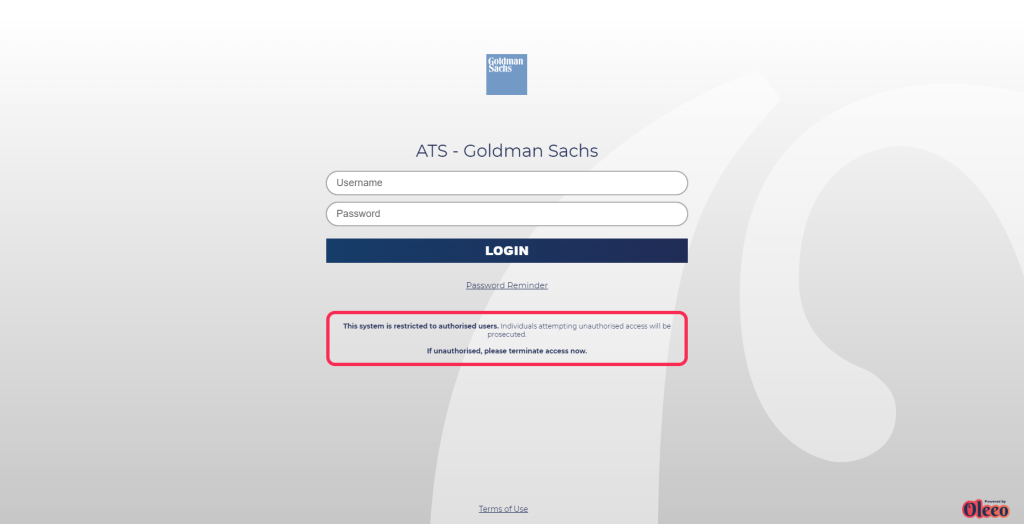

If you do not know about them, no worries, it happens that charts get created by people; yes, real people like you and me buy, but institutions do sometimes buy routing orders through ATS (I think that's Alternative Trading Systems).

Alternative Trading Systems

An Alternative Trading System (ATS) is an SEC-regulated trading venue which serves as an alternative to trading at a public exchange. In some ATSs (also referred to as “dark pools”) buyers and sellers are matched anonymously without pre-trade display of bids and offers, and the trade is publicly reported upon execution. It is important to note that the basic function of a broker-operated ATS is an electronic manifestation of a previously manual trading process, when trading desks would first try to execute trades internally before sending the order to a public exchange. Industry reporting estimates total US “dark pool” volume to be less than 10% of all US stock market transactions (Rosenblatt Securities, 2009). The vast majority of trades still occur at exchanges and ECNs.

Goldman Sachs: Insights

You did not hear it from me; you got it from Goldman Sachs.

Bottom Line, from March 6 to March 17, someone was super active in those dark pools and loaded enough SPY to kill poverty (I am not joking).

I will not overload you with it, but the chart I added with those color lines can give you a sense of why the SP500 can be above 4,100 points.

It's not luck, not an accident; someone bought plenty of it.

The Sellers and so-called Bears are pretty exhausted from all the selling in 2022.

Go figure...!

Photo credit: Matias Reding

Pexels